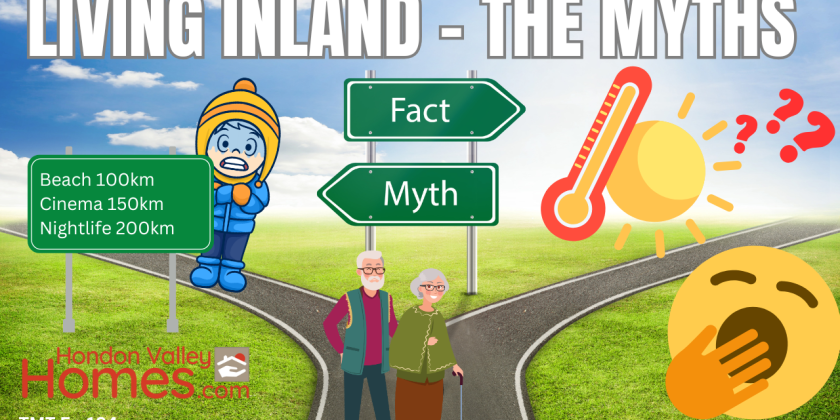

TMT Ep.194 The Biggest Myths about living in Inland Spain..... from somebody who lives inland.

Thinking about moving to inland Spain? You have probably heard all sorts of things—it's too remote, too quiet, or even unbearably hot. But how much of that is actually true? In this video, we’re debunking the biggest myths about life in inland Spain which includes the Hondon Valley and...

Article #45. Retire in Spain: The True Costs of Living in the Hondón Valley

Thinking of swapping dull northern winters for sun-filled Spanish skies? Spain attracts over 100,000 British retirees eager for sunshine, culture, tasty food—and particularly lower living costs. Yet, without proper planning, tax surprises, pension complications, and visa limitations can...

TMT Ep.193 What Does a Spanish Estate Agent Do AFTER the Sale? More Than You Think!

{image} Buying your dream home in Spain is just the beginning. In this video, we explain what a dedicated Spanish real estate agent like Hondon Valley Homes does for clients after they’ve got the keys in hand. From recommending trusted tradespeople to helping you register with the town...

Article 44: Spanish Driving Licence Points System Explained – Stay Safe and Keep Your Points!

Understanding the Spanish Driving Points System: What You Need to Know Driving in Spain? Then it’s worth getting to grips with the points-based driving licence system . It’s not as scary as it sounds — think of it as a reward-and-penalty game where good driving keeps you winning. Here’s...

Buying Post BREXIT

Buying Post BREXIT

Buying in Spain in 10 steps

Buying in Spain in 10 steps

Presenting Your Villa for Sale

Presenting Your Villa for Sale