Preparing Your Villa for Sale in the Spring:

A Comprehensive Guide.

As we enter the quieter winter months and the property market start to slow down it is best to make the preparations now if you are thinking of listing your property for sale in the coming months.

As the vibrant beauty of spring approaches and buyers from Northern Europe make contact with Hondon Valley Homes to arrange viewing appointments , it’s the perfect time to prepare your villa for sale in the picturesque Hondon Valley. Selling your property can be a smooth and successful experience if you plan ahead and make sure every detail is in order.

Here is Hondon Valley Homes comprehensive guide to help you get your villa ready for listing in the spring:

1. Choose a Legal and Registered Estate Agent:

2. Select a Competent Lawyer:

2. Select a Competent Lawyer:

3. Review Villa Documentation:

4. Attend to Odd Jobs Around the Villa and Garden:

5. Painting and Decorating:

6. Create a Warm and Inviting Atmosphere:

7. Professional Photography:

8. Set an Appropriate Price:

9. Market Your Property Effectively:

10. Prepare for Viewings:

By following these steps and preparing your villa meticulously, you’ll be well-prepared to list your property in the spring market. With the right guidance from a trustworthy estate agent and lawyer, your villa will attract eager buyers, making your selling experience in the Hondon Valley a successful and enjoyable one.

Article author:

Steven Bromley is the owner of Hondon Valley Homes and has been selling properties in and around the Hondon Valley since 2006. Hondon Valley Homes are a legal registered, licenced and insured real estate agency as required by law.

Curious about the ultimate cost of living showdown between the UK 🇬🇧 and Spain 🇪🇸? Join us in this eye-opening comparison video as we dive deep into the nitty-gritty of expenses, affordability, and lifestyle in two similar Europen cities / destinations. From groceries & transportation to entertainment – we’ve got the numbers laid out to help you make informed decisions whether you’re planning to settle down or explore new horizons. 🏡

You can check the costs comparison yourself here: https://www.numbeo.com/cost-of-living/

eMail: [email protected]

Web: www.HondonValleyHomes.com

WhatsApp: https://wa.me/message/GBKYDT5YFKXLE1

⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈

Social Media.

Facebook: https://www.facebook.com/hondonvalleyhomes

Instagram: https://www.instagram.com/hondonvalleyhomes/

Youtube: https://www.youtube.com/c/StevenatHondonValleyHomes

Our website is full of useful information for buyers and sellers alike. We have information and advice videos, free to download eBooks as well as blogs and articles to educate our buyers and sellers so they make the most informed decisions.

Buyers Videos: https://hondonvalleyhomes.com/category/for-buyers/

Buyers ebooks: https://hondonvalleyhomes.com/free-buyers-guide/

Buyers FAQ: https://hondonvalleyhomes.com/faq_categories/buyers-faq/

Sellers Videos: https://hondonvalleyhomes.com/category/for-sellers/

Sellers eBooks: https://hondonvalleyhomes.com/free-sellers-guide/

Sellers FAQ: https://hondonvalleyhomes.com/faq_categories/sellers-faq/

#hondonvalleyhomes

#reasonstoliveinspain

They were all the rage between 2008-20012 when the Spanish property market was having a “difficult” period…… but where are they now? Do clients still use them? All this and more answered in this week’s episode of TMT.

eMail: [email protected]

Web: www.HondonValleyHomes.com

WhatsApp: https://wa.me/message/GBKYDT5YFKXLE1

⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈

Social Media.

Facebook: https://www.facebook.com/hondonvalleyhomes

Instagram: https://www.instagram.com/hondonvalleyhomes/

Youtube: https://www.youtube.com/c/StevenatHondonValleyHomes

Our website is full of useful information for buyers and sellers alike. We have information and advice videos, free to download eBooks as well as blogs and articles to educate our buyers and sellers so they make the most informed decisions.

Buyers Videos: https://hondonvalleyhomes.com/category/for-buyers/

Buyers ebooks: https://hondonvalleyhomes.com/free-buyers-guide/

Buyers FAQ: https://hondonvalleyhomes.com/faq_categories/buyers-faq/

Sellers Videos: https://hondonvalleyhomes.com/category/for-sellers/

Sellers eBooks: https://hondonvalleyhomes.com/free-sellers-guide/

Sellers FAQ: https://hondonvalleyhomes.com/faq_categories/sellers-faq/

#hondonvalleyhomes

#reasonstoliveinspain

Spain has recently introduced a new animal welfare law that came into effect on 29th September 2023

The primary goal of this law is to combat the mistreatment, abandonment, and slaughter of animals.

The law applies to all animals, whether domestic or wild, under human care.

The legislation introduces stricter regulations for pet owners and prohibits the use of spikes, electric shock collars, or tethering animals to moving motor vehicles. It also bans circuses featuring animals (with exceptions for popular bull-related festivities) and the sale of pets in commercial pet stores.

The law requires dog owners to complete a free online training course and obtain liability insurance (to be enforced when a new government is formed) Shipping companies, airlines, and trains are obligated to facilitate pet access while ensuring the safety and proper behavior of the animals.

Restrictions on leaving pets unattended for extended periods have been implemented, and there is a maximum limit of five pets per owner.

Euthanasia is prohibited except under veterinary criteria.

Measures have been implemented to control pet breeding, including mandatory identification via microchip and sterilization for cats. Notably, certain animals such as dangerous or poisonous species and large wild mammals and reptiles (excluding turtles) are no longer allowed to be kept as pets in homes.

Individuals found guilty of animal abuse may face imprisonment for a period exceeding one year, potentially extending up to 36 months in cases resulting in the death of an animal. Financial penalties ranging from 500 to 200,000 euros will also be imposed, varying based on the gravity of the violation.

Critics have pointed out that one of Spain’s most infamous national pastimes, bullfighting, remains unaffected by the new legislation.

In conclusion, Spain’s new animal welfare law is a significant step towards protecting animals from mistreatment and abuse. The law introduces stricter regulations for pet owners and prohibits certain practices that can cause harm to animals. However, critics have pointed out that more needs to be done to address issues such as bullfighting. It remains to be seen how effective this new legislation will be in practice.

You can find a full and more detailed description of the laws in English on the link below:

https://www.citizensadvice.org.es/new-law-on-animal-welfare/

In this weeks episode we take a look at the much publicised Mediterranean diet and if it is as good for you as everybody says and perhaps more importantly, when you come to Spain is it something you will follow or will you seach out your old familiar favourites from the coastal supermarkets?

eMail: [email protected]

Web: www.HondonValleyHomes.com

WhatsApp: https://wa.me/message/GBKYDT5YFKXLE1

⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈

Social Media.

Facebook: https://www.facebook.com/hondonvalleyhomes

Instagram: https://www.instagram.com/hondonvalleyhomes/

Youtube: https://www.youtube.com/c/StevenatHondonValleyHomes

Our website is full of useful information for buyers and sellers alike. We have information and advice videos, free to download eBooks as well as blogs and articles to educate our buyers and sellers so they make the most informed decisions.

Buyers Videos: https://hondonvalleyhomes.com/category/for-buyers/

Buyers ebooks: https://hondonvalleyhomes.com/free-buyers-guide/

Buyers FAQ: https://hondonvalleyhomes.com/faq_categories/buyers-faq/

Sellers Videos: https://hondonvalleyhomes.com/category/for-sellers/

Sellers eBooks: https://hondonvalleyhomes.com/free-sellers-guide/

Sellers FAQ: https://hondonvalleyhomes.com/faq_categories/sellers-faq/

#hondonvalleyhomes

#reasonstoliveinspain

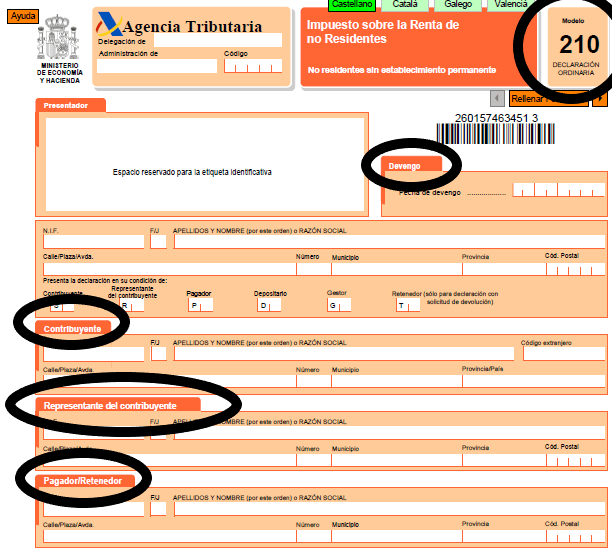

If you’ve recently purchased property in the picturesque Hondon Valley or anywhere else in Spain, it’s essential to grasp the concept of the Spanish Non-Residence Tax. This tax is a part of Spanish fiscal regulations that affect non-resident property owners. In this article, we’ll break down what the Spanish Non-Residence Tax is and how you can efficiently pay it.

The Spanish Non-Residence Tax, often referred to as the Impuesto sobre la Renta de No Residentes (IRNR), is a tax imposed on individuals who own property in Spain but do not reside there permanently. This tax is applicable to both EU and non-EU citizens, and its primary purpose is to collect revenue from non-resident property owners.

If you are a non-resident property owner in Spain, you are required to pay the Spanish Non-Residence Tax. Being a non-resident means that you spend less than 183 days a year in Spain and do not have an official residency status.

The tax is based on a fixed percentage of the property’s assessed value, also known as the cadastral value. This value is determined by the Spanish tax authorities and is usually lower than the property’s market value. The specific tax rate depends on the type of property:

The Spanish Non-Residence Tax must be paid annually, and the tax year corresponds to the calendar year. Here’s a simple step-by-step guide on how to pay it:

In summary, the Spanish Non-Residence Tax is a mandatory tax for non-resident property owners in Spain. It’s calculated based on the cadastral value of your property and the type of property you own. To pay it, complete Form 210, and submit your payment before December 31st of each tax year. Staying informed and fulfilling your tax obligations will help you enjoy your property investment in Spain without any legal issues. If you have any questions or need assistance, consult with a local tax professional or your trusted real estate agent.

At Hondon Valley Homes we have built up and exhaustive list of qualified professionals (lawyers, bankers, architects, foreign exchange, IT, transport, insurance, health….) to help you in every aspect of your move here to Spain as either a resident or for a holiday home. As a client of Hondon Valley Homes you will benefit from this 18 years of experience to make your transition to this beautiful part of the world as simple and stress free as possible.

Join us in this week’s episode of Two Minute Tuesday as we delve into the contrasting realms of Spanish residency and citizenship. In Episode 155, we explore the divergent aspects of these two statuses, shedding light on which option might be most suitable for your new life in Spain. Tune in to gain valuable insights and make an informed decision about your legal status in this captivating country.

Our website is far more than just pretty villas, blue sky and pools. We like to give our buyers and sellers alike as much information as possible so that they can make informed buying and selling decisions. There is a huge amount of work involved in producing this “knowledge base” so this video highlights some of the areas that may save you some browsing time.

eMail: [email protected]

Web: www.HondonValleyHomes.com

WhatsApp: https://wa.me/message/GBKYDT5YFKXLE1

⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈

Social Media.

Facebook: https://www.facebook.com/hondonvalleyhomes

Instagram: https://www.instagram.com/hondonvalleyhomes/

Youtube: https://www.youtube.com/c/StevenatHondonValleyHomes

Our website is full of useful information for buyers and sellers alike. We have information and advice videos, free to download eBooks as well as blogs and articles to educate our buyers and sellers so they make the most informed decisions.

Buyers Videos: https://hondonvalleyhomes.com/category/for-buyers/

Buyers ebooks: https://hondonvalleyhomes.com/free-buyers-guide/

Buyers FAQ: https://hondonvalleyhomes.com/faq_categories/buyers-faq/

Sellers Videos: https://hondonvalleyhomes.com/category/for-sellers/

Sellers eBooks: https://hondonvalleyhomes.com/free-sellers-guide/

Sellers FAQ: https://hondonvalleyhomes.com/faq_categories/sellers-faq/

#hondonvalleyhomes

#reasonstoliveinspain

#hondonvalleyhomes

#reasonstoliveinspain

#villa #spain_vacations #spain #buying #villas #property #spain🇪🇸 #propertyforsale #investmentproperty #homebuying #buyingahome #propertyfinder

The Essential Role of Spanish Notaries in Buying and Selling Property.

Introduction

Spain’s enchanting landscapes, vibrant culture, and sunny climate have long made it a top choice for expats looking to invest in property. However, navigating the Spanish real estate market can be quite different from what you might be accustomed to in your home country. One key player in this process is the Spanish notary. In this article, we’ll explore what a Spanish notary is, what they do, and why they are essential in the sale and purchase of Spanish property.

What is a Spanish Notary?

![]() A Spanish notary, or “Notario” in Spanish, is a legal professional with a unique role in the Spanish legal system. They are appointed by the government and serve as impartial witnesses to various legal transactions, including property sales and purchases. Unlike notaries in some other countries, Spanish notaries are highly trained legal experts who play a vital role in ensuring the legality and fairness of various legal documents.

A Spanish notary, or “Notario” in Spanish, is a legal professional with a unique role in the Spanish legal system. They are appointed by the government and serve as impartial witnesses to various legal transactions, including property sales and purchases. Unlike notaries in some other countries, Spanish notaries are highly trained legal experts who play a vital role in ensuring the legality and fairness of various legal documents.

What Do Spanish Notaries Do?

Why Are Spanish Notaries Important?

Conclusion

In the world of Spanish real estate, a Spanish notary is an indispensable figure. They bring legal expertise, impartiality, and a commitment to ensuring the legality and fairness of property transactions. Whether you are buying or selling property in Spain, having a Spanish notary by your side is not just a legal requirement but also a valuable source of guidance and security. So, when you venture into the Spanish property market, remember that the notary is your trusted partner in making your dreams of owning a piece of this beautiful country a reality.

Steven Bromley Aug 23.

Decree 98/2022 makes the mandatory registration of real estate agents in the Valencia region mandatory from October 2023.

But it is not as simple as putting your name on a database. You need to pass a 250hour 16/17 module course with examinations and take out the required liability insurances.

The industry is finally becoming more professional…… so is your agent compiling….

HONDON VALLEY HOMES: API 00608 & RAICV 1494

UPDATE:

Now You Can Check. Click on the link below, select Alicante as the region and then select the town that your agent is located in a check. https://sforms.gva.es/sformssistemaexplotacion/servletObtenerXMLns/ObtenerXMLorig?formulario=62953&SF_SIS_ICP=1&ssl_redireccionado=true&idsesion=1667564555420

eMail: [email protected]

Web: www.HondonValleyHomes.com

WhatsApp: https://wa.me/message/GBKYDT5YFKXLE1

⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈⇈

Social Media.

Facebook: https://www.facebook.com/hondonvalleyhomes

Instagram: https://www.instagram.com/hondonvalleyhomes/

Youtube: https://www.youtube.com/c/StevenatHondonValleyHomes

Our website is full of useful information for buyers and sellers alike. We have information and advice videos, free to download eBooks as well as blogs and articles to educate our buyers and sellers so they make the most informed decisions.

Buyers Videos: https://hondonvalleyhomes.com/category/for-buyers/

Buyers ebooks: https://hondonvalleyhomes.com/free-buyers-guide/

Buyers FAQ: https://hondonvalleyhomes.com/faq_categories/buyers-faq/

Sellers Videos: https://hondonvalleyhomes.com/category/for-sellers/

Sellers eBooks: https://hondonvalleyhomes.com/free-sellers-guide/

Sellers FAQ: https://hondonvalleyhomes.com/faq_categories/sellers-faq/

#hondonvalleyhomes

#reasonstoliveinspain