Expert Advice

Knowledgebase #25 Non Resident Tax What it is and How to Pay it.

If you’ve recently purchased property in the picturesque Hondon Valley or anywhere else in Spain, it’s essential to grasp the concept of the Spanish Non-Residence Tax. This tax is a part of Spanish fiscal regulations that affect non-resident property owners. In this article, we’ll break down what the Spanish Non-Residence Tax is and how you can efficiently pay it.

What is Spanish Non-Residence Tax?

The Spanish Non-Residence Tax, often referred to as the Impuesto sobre la Renta de No Residentes (IRNR), is a tax imposed on individuals who own property in Spain but do not reside there permanently. This tax is applicable to both EU and non-EU citizens, and its primary purpose is to collect revenue from non-resident property owners.

Who Needs to Pay It?

If you are a non-resident property owner in Spain, you are required to pay the Spanish Non-Residence Tax. Being a non-resident means that you spend less than 183 days a year in Spain and do not have an official residency status.

How is it Calculated?

The tax is based on a fixed percentage of the property’s assessed value, also known as the cadastral value. This value is determined by the Spanish tax authorities and is usually lower than the property’s market value. The specific tax rate depends on the type of property:

- Urban Properties (e.g., apartments, townhouses): For these types of properties, the tax rate is typically 1.1% of the cadastral value.

- Rural Properties (e.g., villas, fincas): The tax rate for rural properties is usually 2% of the cadastral value.

When and How to Pay?

The Spanish Non-Residence Tax must be paid annually, and the tax year corresponds to the calendar year. Here’s a simple step-by-step guide on how to pay it:

- Calculate Your Tax Liability: Determine the cadastral value of your property and apply the applicable tax rate. This will give you the amount you need to pay.

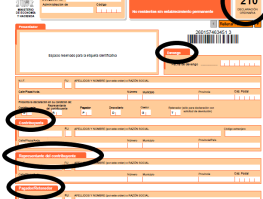

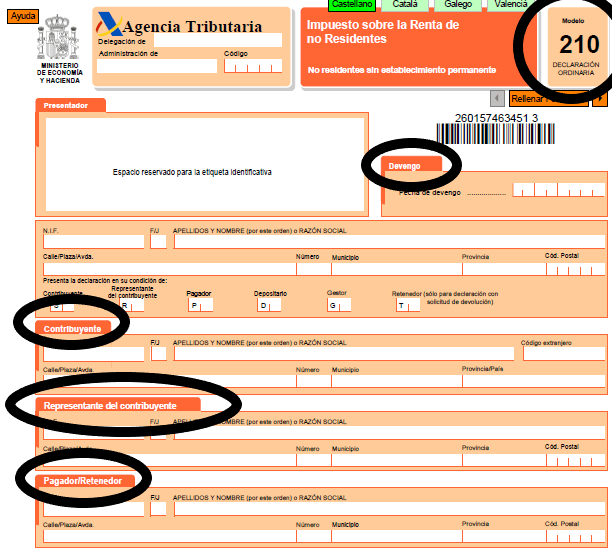

- Complete the Form: You’ll need to complete Form 210, which is the tax declaration form for non-resident property owners. This form can be downloaded from the Spanish tax authority’s website.

- Submit Your Payment: Pay the calculated tax amount using a Spanish bank or through authorized financial institutions. It’s essential to do this before December 31st of the tax year to avoid penalties.

- Keep Records: Make sure to keep records of your tax payments, as you may need to provide proof of payment in the future.

Conclusion

In summary, the Spanish Non-Residence Tax is a mandatory tax for non-resident property owners in Spain. It’s calculated based on the cadastral value of your property and the type of property you own. To pay it, complete Form 210, and submit your payment before December 31st of each tax year. Staying informed and fulfilling your tax obligations will help you enjoy your property investment in Spain without any legal issues. If you have any questions or need assistance, consult with a local tax professional or your trusted real estate agent.

At Hondon Valley Homes we have built up and exhaustive list of qualified professionals (lawyers, bankers, architects, foreign exchange, IT, transport, insurance, health….) to help you in every aspect of your move here to Spain as either a resident or for a holiday home. As a client of Hondon Valley Homes you will benefit from this 18 years of experience to make your transition to this beautiful part of the world as simple and stress free as possible.

FR

FR ES

ES NL

NL DE

DE NO

NO PL

PL