Expert Advice

KNOWLEDGEBASE #32 Understanding the Spanish Declaration of Wealth Form 720

What is Form 720?

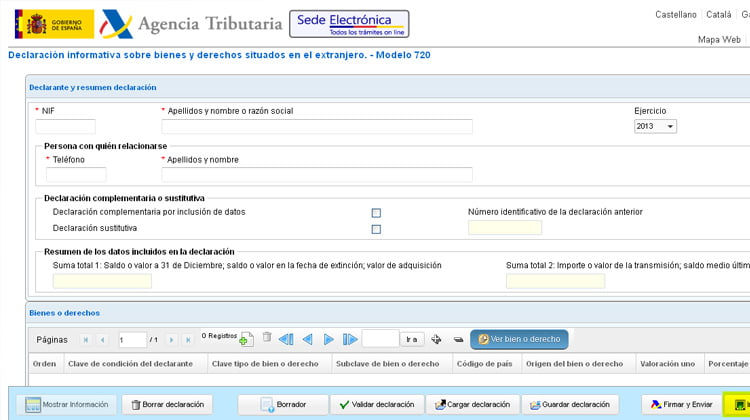

Form 720, also known as “Modelo 720,” is a declaration form introduced by the Spanish Tax Authorities in 2012. Its primary purpose is to encourage the disclosure of previously undeclared foreign assets held by Spanish tax residents. While it initially served as a way to regularize past undeclared assets without penalties, failing to accurately declare assets on Form 720 can now result in significant fines.

Who is Required to File Form 720?

- Spanish Tax Residents: If you spend more than 183 days in Spain within a calendar year (from January 1st to December 31st), you are considered a Spanish tax resident. This period includes time spent abroad for work or holidays. Even if circumstances (such as illness or pandemic-related lockdowns) require you to stay in Spain beyond 183 days, you are still considered a Spanish tax resident.

- Spouses and Dependent Children: If your spouse and dependent children are Spanish tax residents, the authorities will typically consider you a Spanish tax resident as well unless you can demonstrate otherwise.

When Do You Need to File Form 720?

You must file Form 720 in Spain if your total assets abroad exceed 50,000 Euros in any of the following categories:

- Foreign Bank Accounts: Money held in banking institutions abroad.

- International Investments: Securities representing equity in foreign entities.

- Overseas Real Estate: Property located abroad, including associated rights.

The filing requirements are as follows:

- Single Category Over 50,000 Euros: If your assets in a single category exceed 50,000 Euros, you must file Form 720 for that specific category.

- Multiple Categories Over 50,000 Euros Each: If you have assets in multiple categories, and the total value exceeds 50,000 Euros, you must file Form 720, including all assets from every category.

Why Is Form 720 Important?

- Transparency: Form 720 ensures transparency regarding foreign assets in your tax filings. While the form itself doesn’t incur immediate payment, what you declare impacts your Personal Income and Wealth Tax Returns.

- Heavy Fines for Non-Compliance: The Modelo 720 is highly controversial due to substantial fines for non-disclosure. Even if it doesn’t necessarily mean extra taxes, failing to submit the form can lead to penalties.

- Detecting Undisclosed Assets: The aim of Form 720 is to identify any previously undisclosed assets or income that may be considered taxable in Spain.

Remember, accuracy and thoroughness are crucial when completing Form 720. Misreporting or underreporting can have serious consequences. If you’re unsure, seek professional tax advice to ensure compliance.

In summary, if you’re a Spanish tax resident with assets abroad, timely and accurate submission of Form 720 is essential. It’s a step toward financial transparency and compliance with Spanish tax regulations.

As with any fiscal advice this is for in formation only and you should speak to your lawyer or gestor to get information specific to your financial circumstances.

Author: Steven Bromley 27.02.2024

FR

FR ES

ES NL

NL DE

DE NO

NO PL

PL